The United Arab Emirates (“UAE”) published Federal Decree-Law No. (47) of 2022 on the Taxation of Corporations and Businesses on December 9, 2022 (from now on referred to as the “Corporate Tax Law”).

A Federal Corporate Tax (often known as a “Corporate Tax”) will be implemented in the UAE on or after 1 June 2023 under the provisions of the Corporate Tax Law, which provides the legal foundation for such an effort.

The UAE wants to speed up its growth and transformation by introducing Corporate Tax to assist it to accomplish its strategic goals. The assurance of a competitive corporate tax policy that complies with international norms and the UAE’s wide network of double tax treaties will solidify the UAE’s status as a top business location.

Given the UAE’s status as a global financial and business hub, the UAE Corporate Tax code draws on best practices from around the world and contains well-recognized and respected principles. As a result, the UAE Corporate Tax policy is ensured to be clear in its implications and easy to understand.

To Whom Does Corporate Tax Apply?

Generally speaking, the following “Taxable Persons” are subject to corporate tax:

Natural persons (individuals) who conduct a business or other activity in the UAE by a Cabinet Decision that will be issued in due course, UAE companies and other juridical persons that are incorporated or effectively managed and controlled in the UAE, and Non-resident juridical persons (foreign legal entities) that have a Permanent Establishment in the UAE (which is explained under [Section 8]).

As “Taxable Persons,” judicial entities established in a UAE Free Zone are likewise subject to corporate tax and must abide by the rules outlined in the corporate tax law.

A Free Zone Person who satisfies the requirements to be regarded as a Qualifying Free Zone Person, however, can profit from a Corporate Tax rate of 0% on their Qualifying Income (the conditions are included in [Section 14]).

Withholding Tax (at a rate of 0%) may apply to non-residents who do not have a permanent establishment in the UAE or who receive income from the UAE that is unrelated to their permanent establishment. A type of corporate tax known as withholding tax is taken out at the source by the payer on behalf of the income recipient. The payment of dividends, interest, royalties, and other types of income across international borders is frequently subject to withholding taxes, which are present in many tax systems.

To whom does the corporate tax not apply?

Due to their significance and contributions to the UAE’s social fabric and economy, certain types of firms or organizations are exempt from corporate tax. The following are examples of Exempt Persons:

Automatic exemption

- Governmental Institutions

- Organizations controlled by the government that are listed in a cabinet decision

If the Ministry of Finance is notified, exemption (and subject to meeting certain conditions)

- Businesses that are extractive

- Businesses that utilize non-extraction of natural resources

Unless specified in a Cabinet Decision, exempt

- Eligible Public Benefit Entities

If the Federal Tax Authority receives an application and grants it, exempt (and subject to meeting certain conditions)

- Pension and social security funds, whether public or private

- Investment Funds That Qualify

- Fully-owned subsidiaries in the UAE of a government entity, a government-controlled entity, a qualifying investment fund, or a public or private pension or social security fund

Government Entities, Government Controlled Entities that are listed in a Cabinet Decision, Extractive Businesses, and Non-Extractive Natural Resource Businesses may all be exempt from being subject to Corporate Tax in addition to being exempt from any registration, filing, and other compliance requirements imposed by the Corporate Tax Law unless they engage in activities that are subject to the charge of Corporate Tax.

A Taxable Person is liable for corporate tax in what way?

The Corporate Tax Law levies revenue on a residency and source basis, similar to the tax systems of the majority of nations. The categorization of the Taxable Person determines the taxation basis that applies.

Income from both domestic and international sources is taxed when it comes to “Resident Persons” (i.e. a residence basis).

Only income obtained from sources within the UAE will be taxed on behalf of “Non-Resident Persons” (i.e. a source basis).

For corporate tax purposes, the residence is defined by a number of particular elements that are outlined in the Corporate Tax Law rather than by a person’s place of residence or domicile. A person will not be a taxable person and hence not be liable for corporate tax if they do not meet the requirements to be either a resident or a non-resident.

Who is called the Resident Person?

For corporate tax, all businesses and other juridical entities that are incorporated, otherwise created, or recognized under UAE law are immediately regarded as resident people. This refers to legal entities established in the UAE under applicable free-zone laws or domestic legislation, as well as legal entities established under a specific statute (e.g. by a special decree).

When efficiently managed and controlled in the UAE, foreign corporations and other juridical entities may also be recognized as resident people for corporate tax reasons. This will be decided based on the particulars of the firm and its operations, with the location of key management and business decisions being a deciding factor.

On income from both domestic and foreign sources, natural persons will be liable for corporate tax as a “Resident Person,” but only to the extent that such income is obtained from a business or other activity that the natural person engages in while residing in the United Arab Emirates. A natural person’s other income would not fall under the purview of corporate tax.

Who is called the Non-Resident Person?

Non-Resident Persons are legal individuals who aren’t Residents and:

- possess a permanent establishment in the UAE or

- get income from the state.

On their taxable income that is related to their permanent establishment, non-resident individuals will be liable to corporate tax (which is explained under Section 8).

There will be no withholding tax applied to some non-residents’ income from the UAE that is not related to a permanent establishment there.

What is an establishment that is permanent?

A crucial premise of international tax law that is used in corporation tax systems all over the globe is the idea of a permanent establishment. To evaluate if and when a foreign person has established sufficient presence in the UAE to justify the commercial earnings of that foreign person being subject to Corporate Tax, the Permanent Establishment concept is central to the UAE Corporate Tax Law.

The OECD Model Tax Convention on Income and Capital’s Article 5 definition, as well as the UAE’s stance under the Multilateral Instrument to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting, served as the foundation for the definition of Permanent Establishment in the Corporate Tax Law. This enables international individuals to determine whether they have a Permanent Establishment in the UAE or not by using the pertinent Commentary of Article 5 of the OECD Model Tax Convention. The terms of any bilateral tax agreements between the UAE and the nation where the non-resident person resides should be taken into account in this evaluation.

What is subject to corporate tax?

A taxable person must pay corporate tax on any taxable income they receive during a tax period.

Corporate Tax would typically be levied once a year, with the Taxable Person determining their burden through self-assessment. This indicates that the Taxable Person files a Corporate Tax Return with the Federal Tax Authority to calculate and pay the Corporate Tax.

The accounting income (i.e., net profit or loss before tax) of the Taxable Person as reported in their financial accounts serves as the basis for computing Taxable Income. To establish their Taxable Income for the applicable Tax Period, the Taxable Person will next need to make a few modifications.

For example, it could be necessary to make adjustments to accounting income for revenue that is exempt from corporate tax and for expenses that are entirely or partially non-deductible for corporate tax reasons.

Which income is exempted from corporate tax?

Additionally, the Corporate Tax Law exempts several forms of revenue from the Corporate Tax. As a result, a Taxable Person will not be charged Corporate Tax on such revenue and cannot deduct any expenses that are connected to it. Taxable individuals who receive exempt income continue to be liable for paying corporate tax on their taxable income.

The fundamental goal of exempting some income from corporate tax is to avoid taxing some forms of revenue twice. Specifically, corporate tax will often not be applied to dividends and capital gains derived from local and overseas shareholdings. In addition, for UAE Corporate Tax, a Resident Person may choose, under certain circumstances, to exclude revenue from a foreign Permanent Establishment.

What are the deductible expenses?

The timing of the deduction may vary depending on the type of expense and the chosen accounting system, but in general, any legitimate business expenses made entirely and exclusively to generate Taxable Income will be deductible. For capital assets, expenses are typically recorded through amortization or depreciation deductions throughout the asset’s or benefit’s economic life.

Dual-purpose costs, such as those incurred for both personal and commercial purposes, must be apportioned; the relevant share is only deductible if it was incurred entirely and exclusively for the taxable person’s business.

For corporate tax purposes, some expenses that are deductible under normal accounting principles might not be entirely deductible. To calculate the Taxable Income, these must be re-added to the Accounting Income. The following are some examples of expenses that may or may not be fully or partially deductible:

Type of expenditure under no deduction

- Bribes

- Penalties and fines (other than amounts awarded as compensation for damages or breach of contract)

- gifts, grants, or donations given to a non-qualifying public benefit organization

- Distributions of dividends and other profits

- The Corporate Tax Law imposes the corporate tax.

- expenditure not made entirely and solely for the taxpaying individual’s business expenditure made in order to derive income exempt from corporate tax

Partial deduction of 50% of the expense’s total cost

- Client entertainment expense

Net interest expenses that surpass a specific de minimis threshold may be deducted.

The amount of earnings before interest, tax, depreciation, and amortization may not exceed 30% of the total amount of earnings (except for certain activities)

- Interest expenditure

What is the rate of corporate tax?

If your taxable income is more than AED 375,000, corporate tax will be charged at a headline rate of 9%. A 0% corporate tax rate will apply to Taxable Income below this cap.

The following rates of corporate tax will be applied to taxable income:

Resident Taxable Persons

| Taxable Income not exceeding AED 375,000 | 0% |

| Taxable Income exceeding AED 375,000 | 9% |

Free Zone Persons Eligible

| Qualifying Income | 0% |

| Taxable Income that does not fall under the criterion of Qualifying Income | 9% |

When can tax groups be formed? What are tax groups?

To be considered as a single Taxable Person for Corporate Tax, two or more Taxable Persons must satisfy specific requirements (see below).

The main firm and all of its subsidiaries must be resident juridical entities, share the same financial year, and compile their financial statements by the same accounting rules to constitute a Tax Group.

To create a Tax Group, the parent firm must additionally:

- hold at least 95% of the voting rights,

- own at least 95% of the subsidiary’s share capital, and

- are eligible for at least 95% of the subsidiary’s earnings and net worth.

- The ownership, rights, and entitlement may be held directly or indirectly through subsidiaries, but an Exempt Person or a Qualifying Free Zone Person cannot be a member of a Tax Group.

How do you figure out a tax group’s taxable income?

The parent company must prepare consolidated financial accounts for each subsidiary that is a member of the Tax Group for the applicable Tax Period to determine the Taxable Income of a Tax Group.

To calculate the Taxable Income of the Tax Group, the transaction between the parent company and each group member and transactions between the group members would be eliminated

Filing, Registering and paying Corporate Taxes

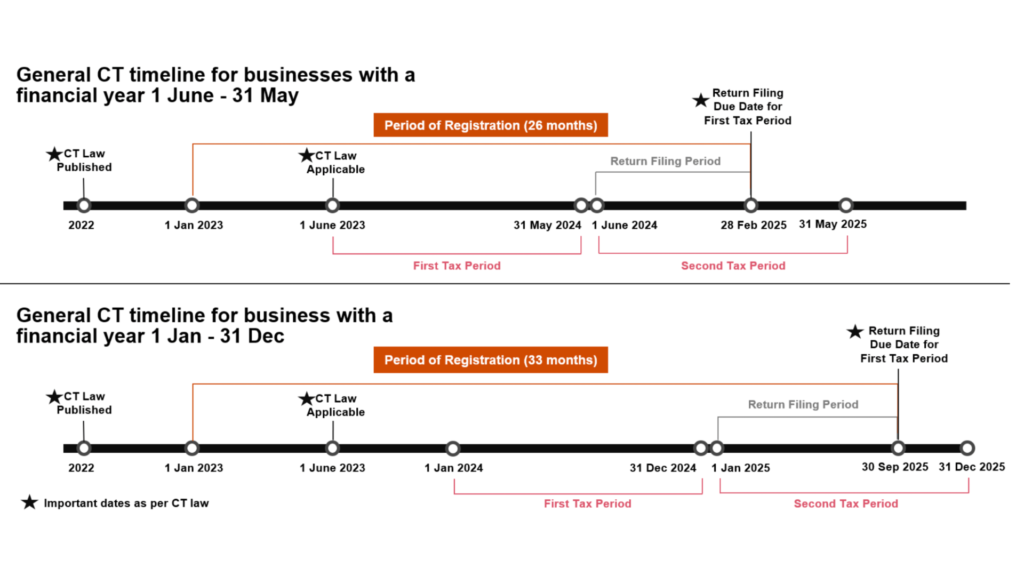

It will be necessary for all Taxable Persons to register for Corporate Tax and get a Corporate Tax Registration Number, including Free Zone Persons. The Federal Tax Authority may ask certain Exempt Persons to register for Corporate Tax.

For each Tax Period, Taxable Persons must submit a Corporate Tax return within nine months after the conclusion of the applicable period.

Normally, the same deadline would also apply to paying any corporate taxes associated with the tax period for which a return is filed.

Below are a few examples of the registration, filing, and payment deadlines for taxpaying individuals whose tax period (financial year) ends on May 31 or December 31. (respectively).